Board Resolutions and Articles of Association are NOT Boring 😄

In this post I am going to show you the power of math to uncover interesting stories and read between the lines – even when reading something that might seem as boring as public filings. 🚗 Buckle up!

Previously and in a series of LinkedIn postings I hypothesized that Affinity Partners, the private equity fund started by Jared Kushner after he left the White House using Saudi oil money, might have sunk as much as $200M into unybrands – one of the many "me too" aggregators that sprung up in the aggregation bubble.

Until November 2022 I was the Chief Technology Officer (CTO) of unybrands where I came to understand from the inside the strengths and significant flaws of the aggregation business model (link 1, 2, and 3) - a business that is challenging to succeed in if you have no expertise in operating e-commerce brands or technology. And, if you are an e-commerce founder thinking of selling to an aggregator, you might discover many aggregators have much in common with Norman Bates.

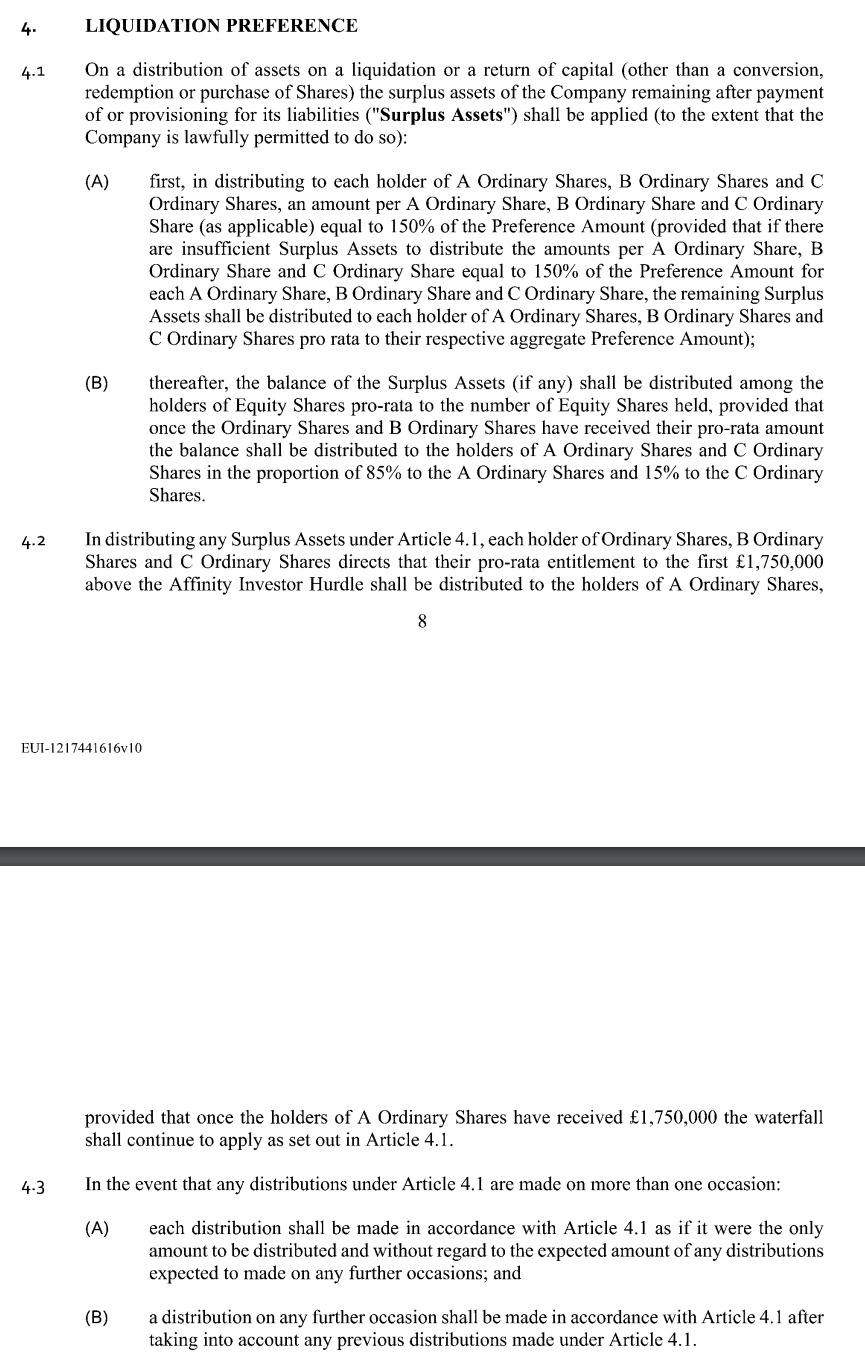

On 31 July 2024 the UK Companies Houses published a series of UBHoldCo Resolutions that I read to find the interesting bits to share with my readers. We are going to focus on this section of the Articles of Association to show you how careful reading, analysis and logic can reveal interesting stories:

🌶️ Distribution Waterfall

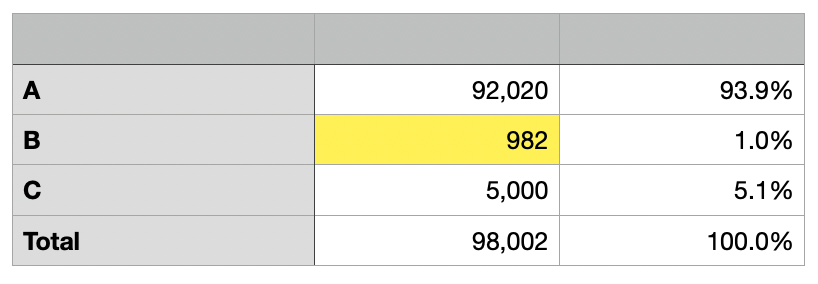

The resolutions in the public filing created 100,000 A Ordinary Shares and authorized the allotment of 92,020 A Ordinary Shares (94%), 982 B Ordinary Shares (1%), and 5,000 C Ordinary Shares (5%). If there is a successful outcome for unybrands, here is how any distribution would happen in plain English:

- Affinity Partners gets paid any unybrands debt they may hold (e.g., the series B press release seems to imply they absorbed the $72M credit facility from CrayHill Aurora Capital because no new charge has been filed for UBHoldCo in the UK Companies Houses) per clause 4.1 "remaining after payment of or provisioning for its liabilities"

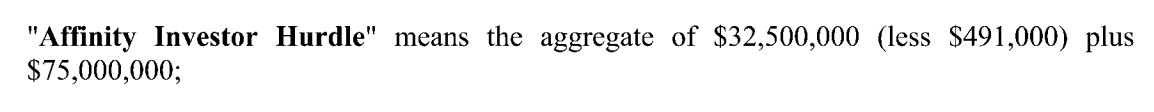

- If the surplus after the prior step clears the Affinity Investor Hurdle of $107M, then A Ordinary Shareholders collect the first $2,275,000 above the Hurdle per clause 4.2

- A, B and C Ordinary Shareholders get paid a 150% liquidation preference on what they paid for their shares per clause 4.1.A

- Anything left over is distributed pro-rata (based on share percentage) to "Ordinary Shareholders", "A Ordinary Shareholders", "B Ordinary Shareholders" and "C Ordinary Shareholders"...

- ...but the distribution allocated pro-rata to "A Ordinary Shareholders" and "C Ordinary Shareholders" will be distributed 85% to "A Ordinary Shareholders" and 15% to "C Ordinary Shareholders" per clause 4.1.B

A, B and C Shareholders

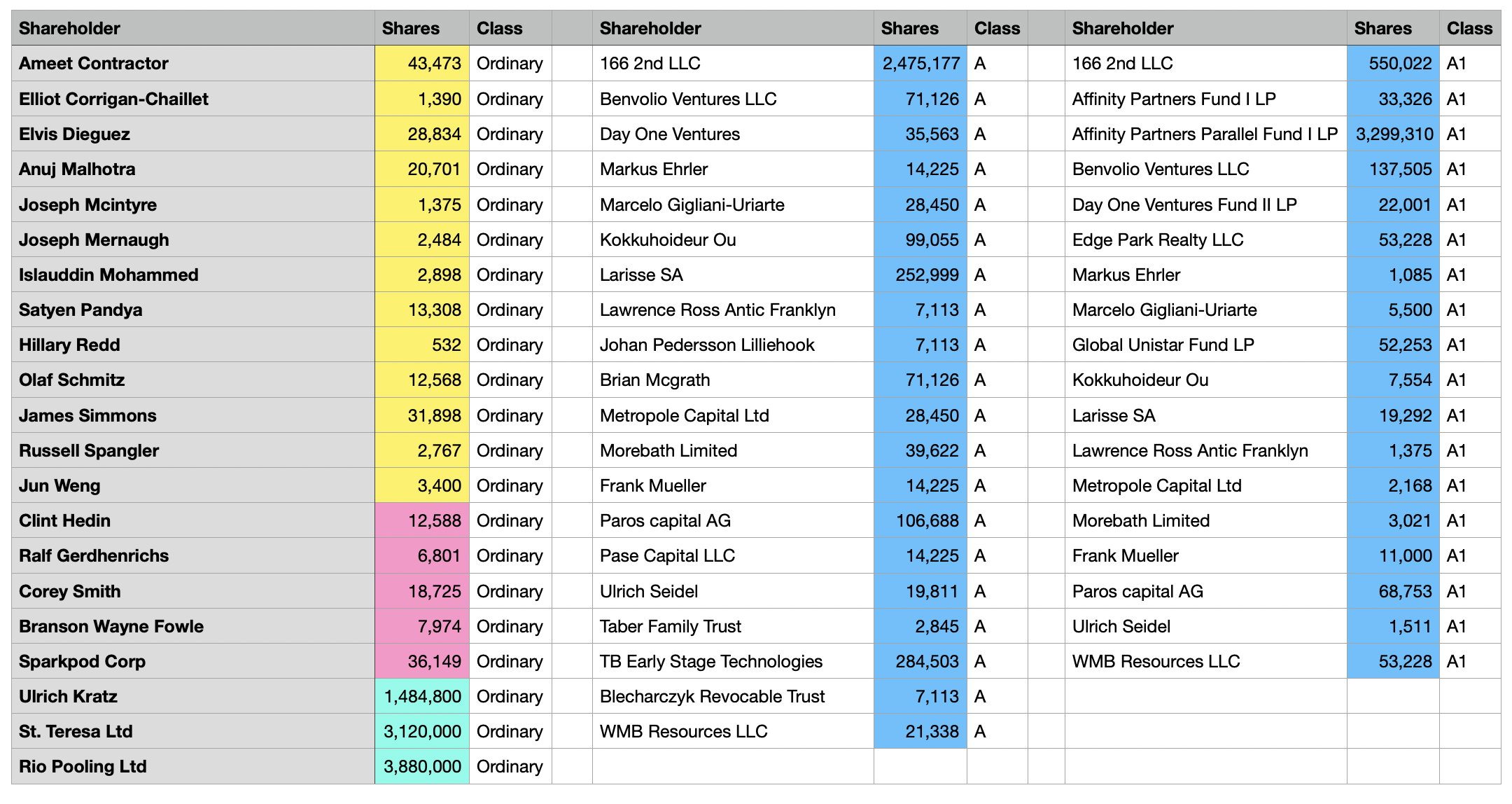

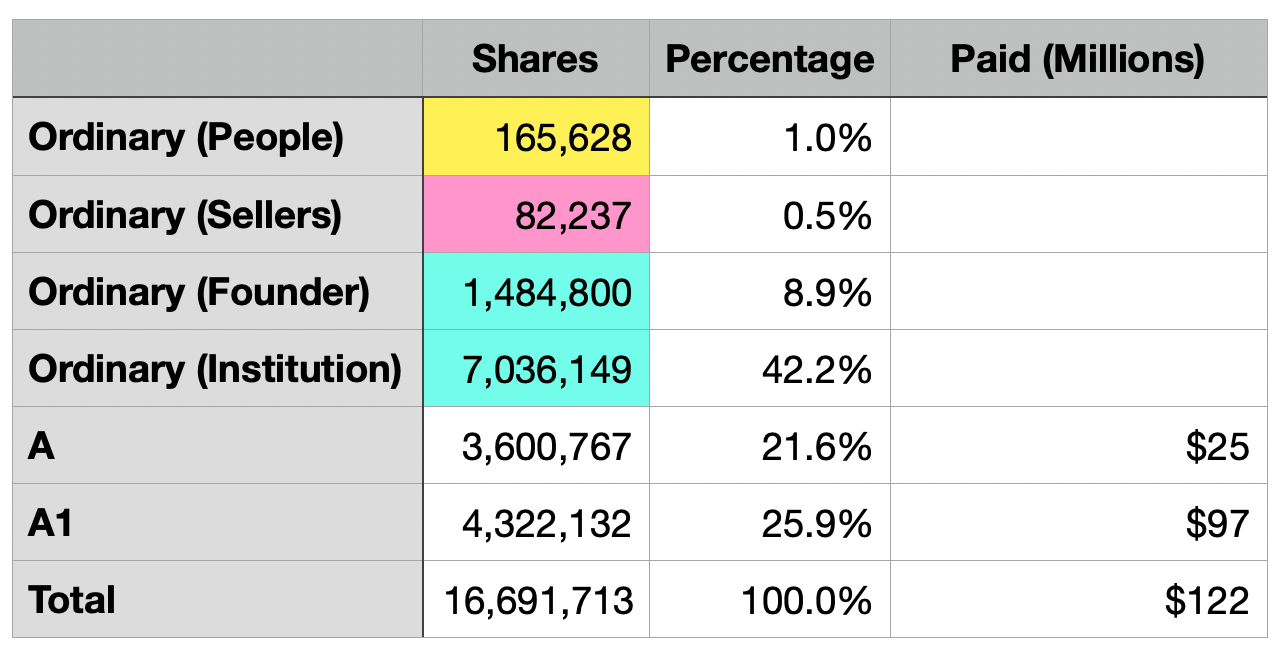

We eventually expect to see a UK Companies Houses public filing (i.e., confirmation statement) affirming the full detail of all shareholders but by analyzing the most recent confirmation statement from unybrands Ltd dated 14 September 2023, it turns out statistical analysis helps us figure out who are the likely A, B and C Ordinary shareholders:

The shareholders in yellow and purple appear to be individual ordinary shareholders – some can clearly be identified as former employees (yellow) based on LinkedIn and others appear to be e-commerce founders (purple) who might have sold to unybrands and accepted shares in their compensation. For example, Branson Wayne Fowle and Ryan Simmons seem to be the co-founders of an e-commerce brand Bryco Goods, LLC that is sold on Amazon. Corey Smith was the founder of an e-commerce brand called Mighty Paw. Similarly Ralf Gerdhenriche is listed on LinkedIn as the founder of FM Naturprodukte GmbH. Clint Hedin is an e-commerce founder and influencer. And based on the name alone, we know Sparkpod Corp is an e-commerce brand.

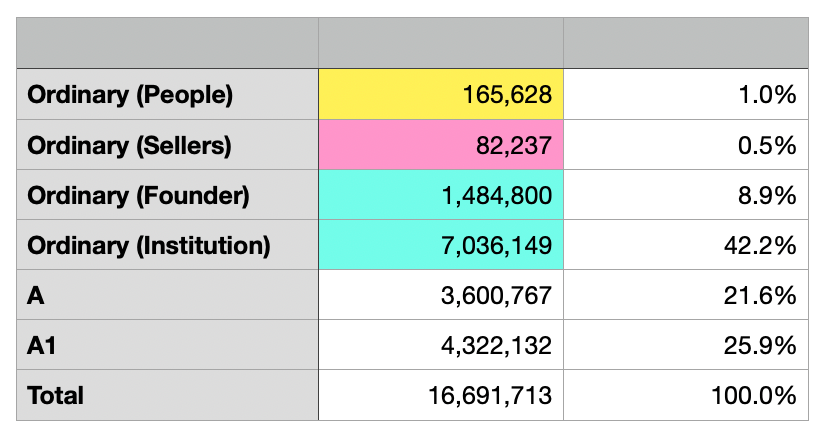

The yellow shareholders had 165,628/16,655,564 shares, which is 1%. This percentage is equal to the B Ordinary Shareholders in UBHoldCo who have 982/98,002 shares. So, it seems that all employees who had ordinary shares in unybrands ltd – perhaps acquired from exercising employee options – were put into the B Ordinary shareholders. The purple shareholders appear to be e-commerce brands acquired by unybrands ltd – they had 82,237/16,655,564 shares, which is 0.5%.

The teal shareholders were ordinary shareholders in unybrands ltd with two special characteristics: Ulrich Kratz is the co-founder & CEO of unybrands and the other two are institutions of some sort. The co-founder alone held 8.9% of all unybrands ltd ordinary shares and the two institutions held 7,036,149/16,655,564 shares, which is 42.2%.

If you compare the table above of unybrands Ltd shareholders against the table below of UBHoldCo shareholders, we can infer that the sellers who had ordinary shares in unybrands Ltd and the co-founder, Ulrich Kratz, who also had ordinary shares in unybrands Ltd, will end up in the C Ordinary shares class.

The 5.1% of the C Ordinary shares is almost exactly the 0.5% held by the e-commerce founders who presumably sold to unybrands plus 1/2 of the 8.9% held by Ulrich Kratz – the co-founder & CEO of unybrands Ltd (i.e., 0.5 + 1/2 x 8.9 = 4.95). Given how many FBA aggregators have crashed and burned, it would make sense for the co-founder & CEO to take a haircut if the underlying business was weak and needed a bailout by Affinity Partners (pure speculation on my part informed by the macro-economic trends in the industry).

Clause 4.1.B in the Articles of Association makes more sense if the co-founder & CEO plus the e-commerce brand sellers are in the C Ordinary share class because – without clause 4.1.B – the pro-rata distribution post the 1.5X liquidation preference would be 92,020/97,020 = 94.8% to the A Ordinary shareholders (versus the C Ordinary shareholders) BUT clause 4.1.B actually sweetens the deal for the C Ordinary shareholders by granting them 15% of the distribution instead of the 5.1% they would be entitled to pro-rata.

In stripping assets from unybrands ltd and transferring them to UBHoldCo, Affinity Partners presumably renegotiated ownership and valuation with at least some shareholders – and it would make sense the co-founder & CEO (plus the e-commerce brands who sold to unybrands) would negotiate a sweeter deal for themselves, which would explain clause 4.1.B. In fact, the clause shifts the distribution in favor of the C Ordinary shareholders such that its the mathematical equivalent of granting the C Ordinary shareholders 15% ownership – almost 3x what they actually have.

Finally, anyone who had A or A1 preferred shares in unybrands Ltd is likely receiving A Ordinary shares in UBHoldCo.

Liquidation Preferences and Math 🤓

This is where it gets interesting. We know from this UK Companies Houses filing that Affinity Partners paid $22.50 per share for 3,332,636 shares (equal to about $75M) in April 2022. This appears in the "Affinity Partners Hurdle" mentioned in the Articles of Association:

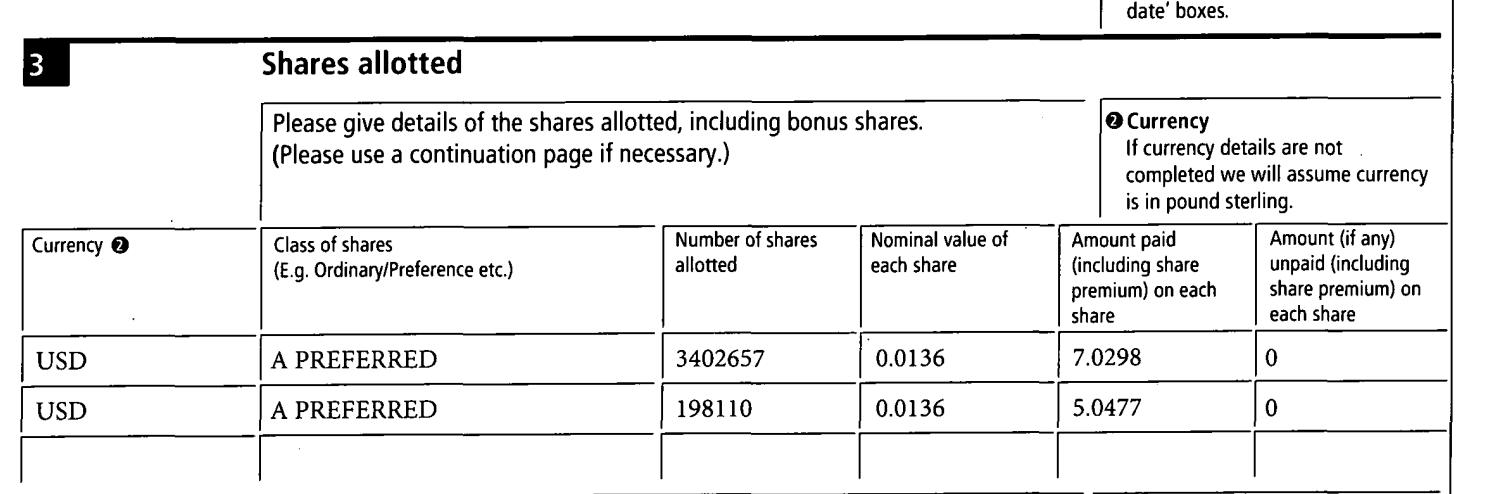

But where does the $32,500,000 (and the $491,000) come from? We have to go back to this UK Companies Houses public filing from 04 February 2021 where 3,600,767 A Preferred series shares were allocated:

This is exactly the number of A Preferred series shares we see in the 14 September 2023 confirmation statement. If you focus on just the A/A1 Preferred series shares, you will notice that the sum of the capital invested in the A Preferred series was $25M (salmon color cell) – which was mentioned in a 17 February 2021 press release. The light green shareholders add up to 198,422 shares, which is just a tad above the 198,110 allotted at $5.0477 in the 04 February 2021 public filing above.

Notice that 166 2nd LLC, which is the Adam & Rebekah Neumann's family office of WeWork infamy, participated in both the A and A1 Preferred series shares. If you add the $25M from the A Preferred series raise to the $12.4M that 162 2nd LLC paid in the A1 Preferred series, you get $37.4M. This is about $5M higher than the $32.5M mentioned in the "Affinity Partners Hurdle" but not far off the mark.

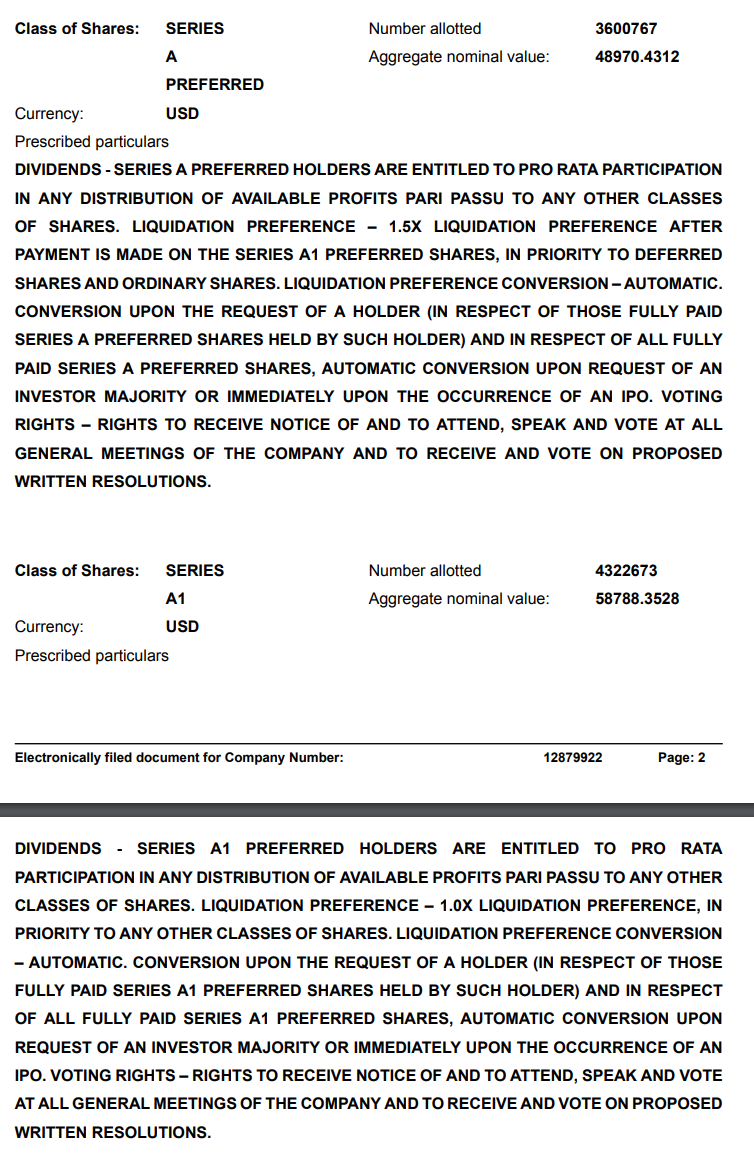

We know that the A1 series had a liquidation preference of 1.0 and the A series had a liquidation preference of 1.5X after the A1 series received its preference:

Now scroll back up and look at the table that had the share count and percentage by share class and let's add to it one more column: how much money each class paid for their shares:

What do you notice? The Ordinary shares plus the A Preferred series hold 74.1% of the voting power but the A1 Preferred series paid 79.5% of the total raised. This creates a problem does it not if the business is not going too well because the majority of the voting power is in the hands of the people who paid the least but the people with the most to lose do not have control.

Within unybrands Ltd, the Ordinary Institutional shareholders plus the co-founder, Ulrich Kratz, held 51% of the voting power – a bare majority – and 166 2nd LLC had the ability to swing decisions in one direction or another because it held 3,025,199 shares or 18.1% of the voting power. However, 166 2nd LLC also had conflicting incentives because it paid $17.4M in the A Preferred series and $12.4M in the A1 Preferred Series, each with different liquidation preferences. Between Affinity Partners and 166 2nd LLC, they controlled 38% of the voting power – this creates an interesting Game of Thrones scenario between 1) Affinity Partners [20%]; 2) 166 2nd LLC [18%]; 3) Ordinary Institutional investors [42%]; and 4) the co-founder [9%].

My hypothesis informed by the mathematics and the macro-economic trends of the industry is as follows:

- All or most of the A Preferred series investors exited with a 1.0 liquidation preference – that would be $25M of the $32.5M

- 166 2nd LLC exited its A1 Preferred series with a haircut receiving $7.5M in return for the A1 Preferred series shares it paid $12.4M for – a -40% haircut on the A1 Preferred series but only a -16% haircut between the A and A1 Preferred shares

- This would leave Affinity Partners in control of unybrands – once its assets were transferred to UBHoldCo per the public filings below:

- Cessation of Unybrands Ltd as a person with significant control on 20 February 2024

- Notification of Ap Investments Ii Ltd as a person with significant control on 20 February 2024

- Notification of Ub Holdco Ltd as a person with significant control on 27 March 2024

- Cessation of Ap Investments II Ltd as a person with significant control on 27 March 2024

Why would Affinity Partners make this type of deal that sees them sinking between $100 - $200M into a "me too" FBA aggregator in an industry that has been crashing and burning since late 2022?

🤷 You'd have to ask Jared Kushner that. Or wait till more public filings are posted to the UK Companies Houses affirming the UBHoldCo shareholder details. Stay tuned!

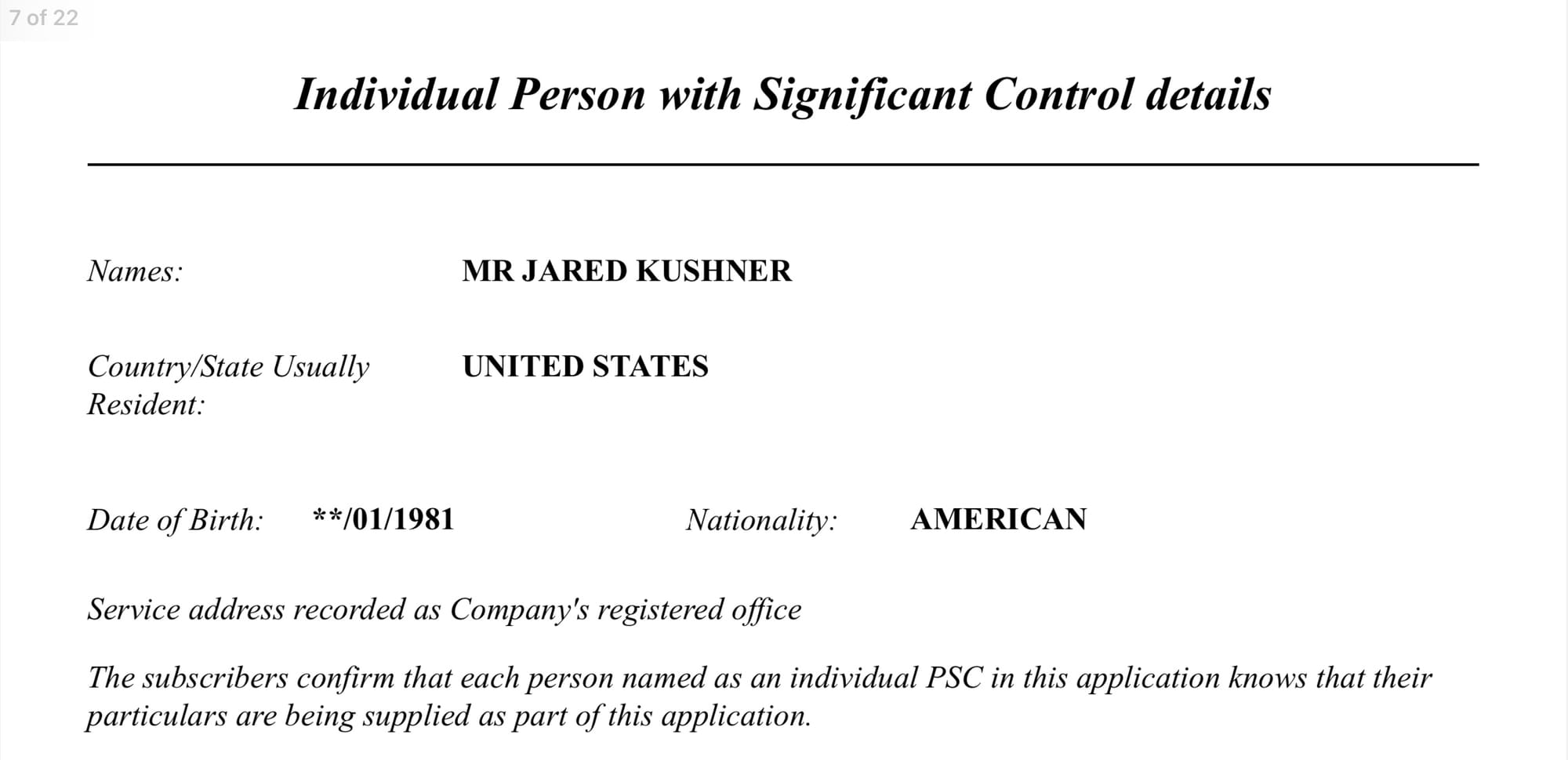

And if you are asking "well how do you know that AP Investments II is owned by Jared Kusher?" just scroll to page 7 of this UK Companies Houses public filing:

Epilogue

I wrote this post listening to Alan Walker - "Shut-Up" because sometimes I dream about opening a portal into another universe to save me from nonsense around me.

One Last Thing...

I am writing a "tell all" book about my experience to share more hilarious and thought provoking stories about the industry and my time at unybrands. I've spoken with multiple people who've shared similar stories from other aggregators that I am adding to my own – reach out if you would like to share your stories with me as well.