Spicy UBHoldCo Public Doc 🌶️

On 3 April 2025, the UK Companies Houses published a 🌶️ confirmation statement for UBHoldCo that we will dissect and compare against the most recent Unybrands Ltd confirmation statement. This new confirmation statement collaborates a significant portion of my prior conclusion.

This post is part of my continuing series about the Amazon aggregator industry to educate the general public, aggregator employees everywhere and e-commerce brand owners considering an exit. It tickles my fancy in writing and provides an opportunity for me to discuss e-commerce and an industry I know very well from professional experience.

Back in August 2024, in Board Resolutions and Articles of Association are NOT Boring 😄 I dissected public documents posted in the UK Companies Houses for Unybrands Ltd to read between the lines and educate the public about the Amazon aggregation industry. I concluded that something unusual was happening at Unybrands Ltd:

My hypothesis informed by the mathematics and the macro-economic trends of the industry is as follows:

All or most of the A Preferred series investors exited with a 1.0 liquidation preference – that would be $25M of the $32.5M

166 2nd LLC exited its A1 Preferred series with a haircut receiving $7.5M in return for the A1 Preferred series shares it paid $12.4M for – a -40% haircut on the A1 Preferred series but only a -16% haircut between the A and A1 Preferred shares

This would leave Affinity Partners in control of unybrands – once its assets were transferred to UBHoldCo per the public filings below:

Cessation of Unybrands Ltd as a person with significant control on 20 February 2024

Notification of Ap Investments Ii Ltd as a person with significant control on 20 February 2024

Notification of Ub Holdco Ltd as a person with significant control on 27 March 2024

Cessation of Ap Investments II Ltd as a person with significant control on 27 March 2024

On 3 April 2025, the UK Companies Houses published a 🌶️ confirmation statement for UBHoldCo that we will dissect and compare against the most recent Unybrands Ltd confirmation statement. This new confirmation statement collaborates a significant portion of my prior conclusion. Buckle up... this is going to be a wild ride!

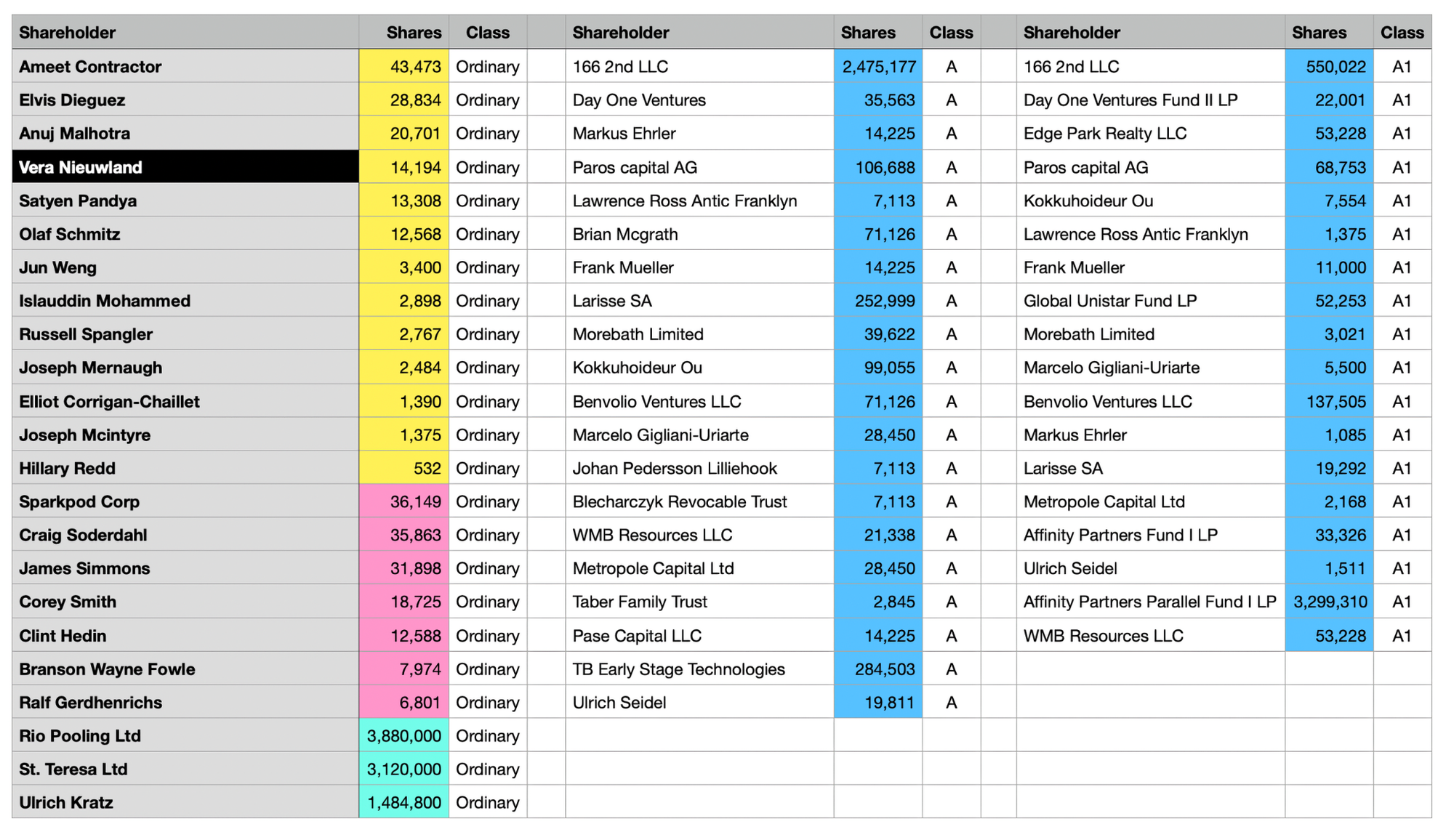

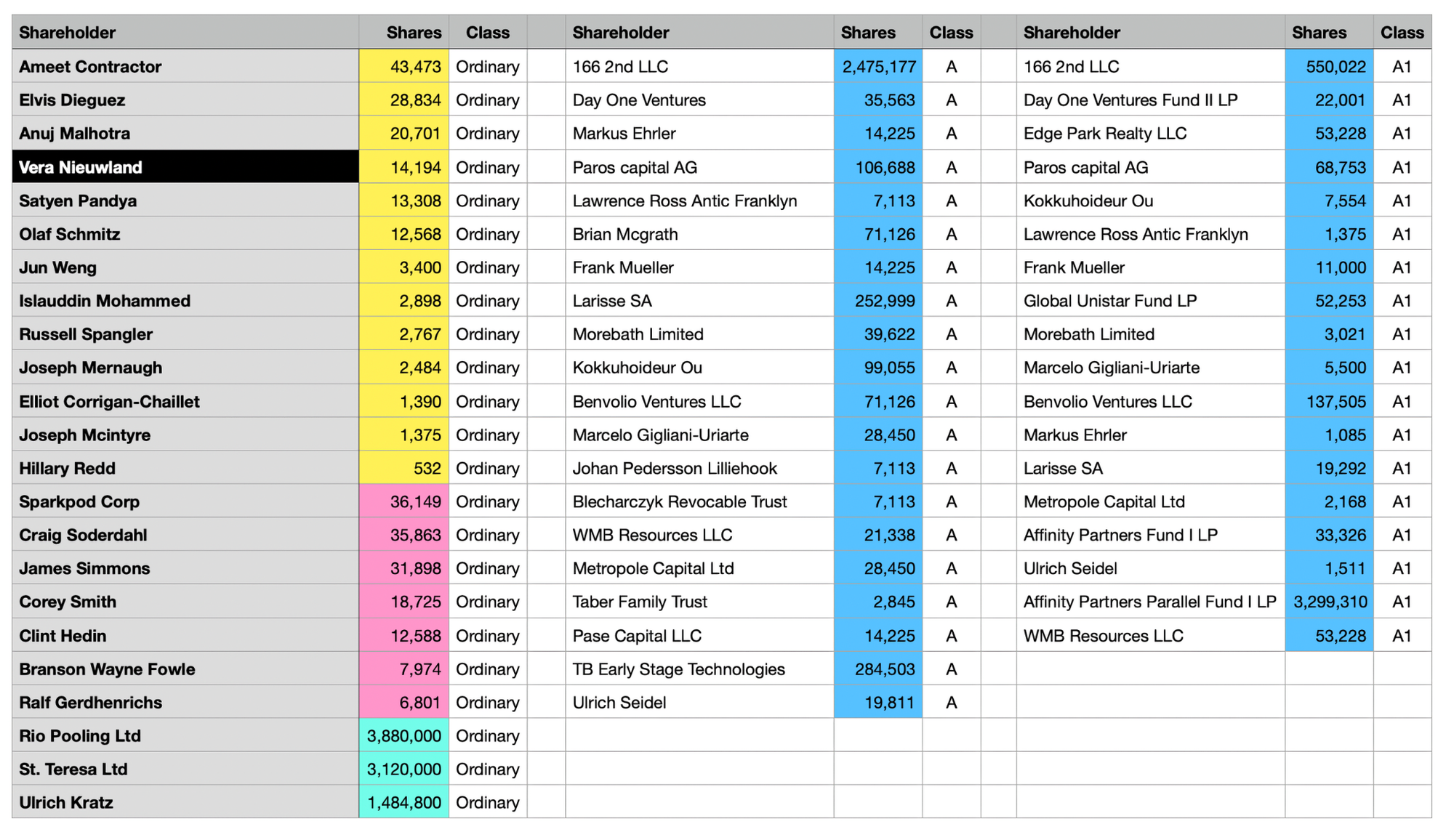

Unybrands Ltd Capitalization Table

Let us start our analysis with the Unybrands Ltd capitalization table (i.e., cap table) from the most recent confirmation statement for Unybrands Ltd.

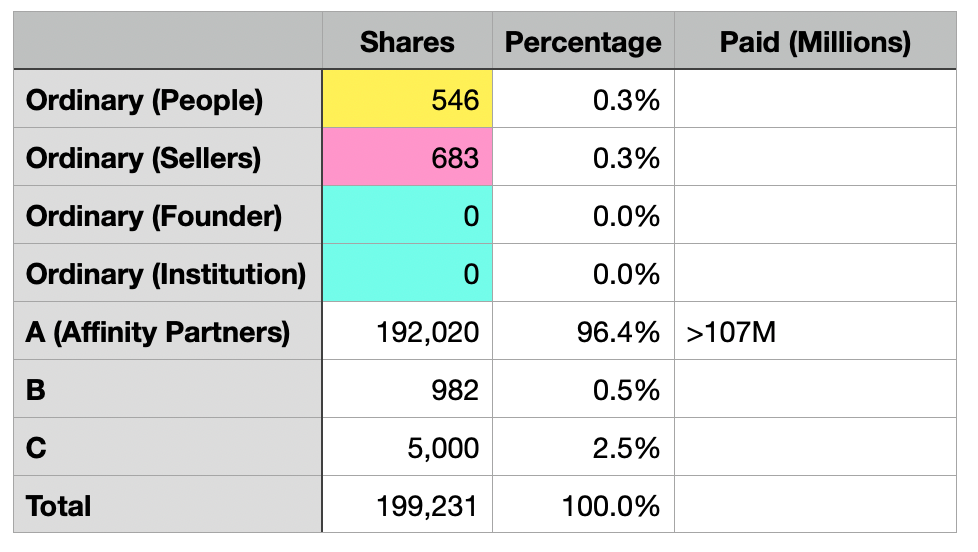

First, comparing the most recent confirmation statement for Unybrands Ltd and UBHoldCo, I slightly updated the Unybrands Ltd cap table to include one person that did not appear in the most recent confirmation statement for Unybrands Ltd. To estimate the number of shares for that person, I used the total number of shares for Unybrands Ltd (16,705,621) versus UBHoldCo (199,231).

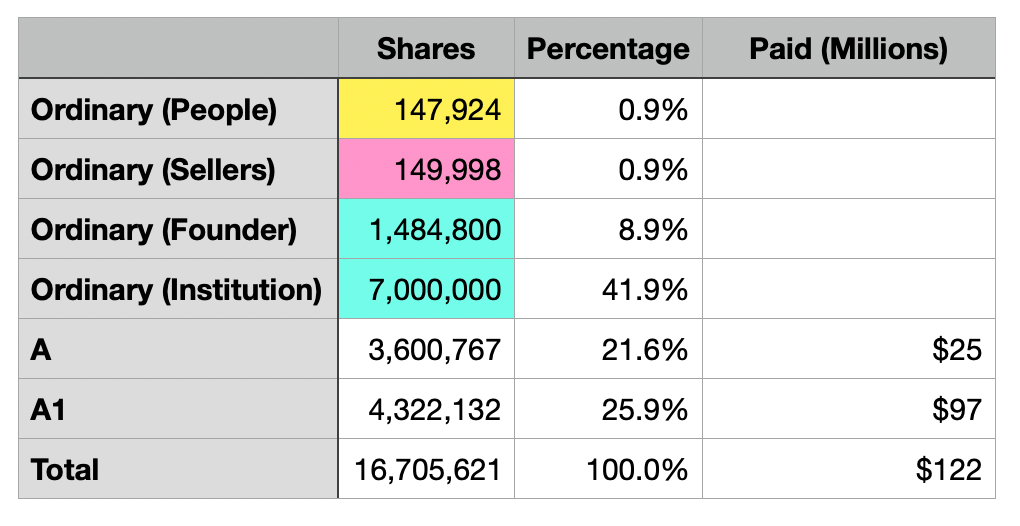

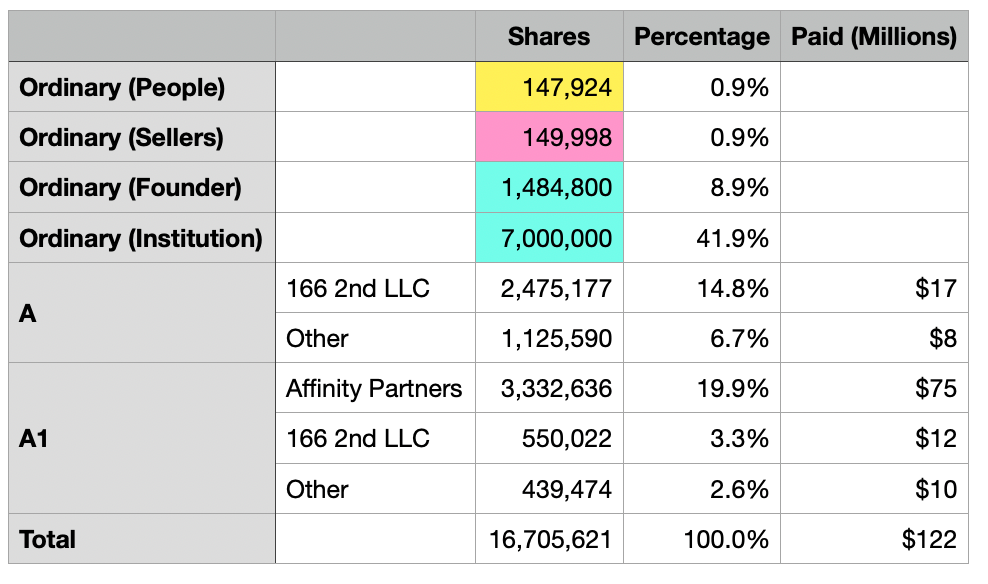

Second, I corrected an error that had color coded one person as a former employee (based on LinkedIn) when they were actually an e-commerce brand founder who had sold his e-commerce brand to Unybrands Ltd. If you group the cap table into 1) ordinary shareholders; 2) class A shareholders; and 3) class A1 shareholders, you arrive at the following picture of Unybrand Ltd's cap table:

The share count and percentages slightly moved across rows (versus my earlier blog post) but essentially the story remains the same based on the public UK Companies Houses documents:

- The ordinary (institutional) shareholders controlled 41.9% of the total shares

- The ordinary (founder) shareholder controlled 8.9% of the total shares

- The A/A1 shareholders controlled 47.5% of the total shares

- Affinity Partners controlled 19.9% of the total shares

- 166 2nd LLC (Adam Neumann) controlled 18.1% of the total shares

- All other A/A1 shareholders controlled 9.5% of the total shares

- The A shareholders paid $25M for their shares

- 166 2nd LLC paying about $17M of the $25M

- Averaged $6.9/share for the A raise in 2021

- The A1 shareholders paid $97M

- Affinity Partners paying at least $75M of the $97M

- Averaged $22.50 for the A1 raise in 2022

- Affinity Partners ($75M) and 166 2nd LLC ($29.8M) invested a total of $104.8M in Unybrands Ltd but only controlled 38% of the total shares

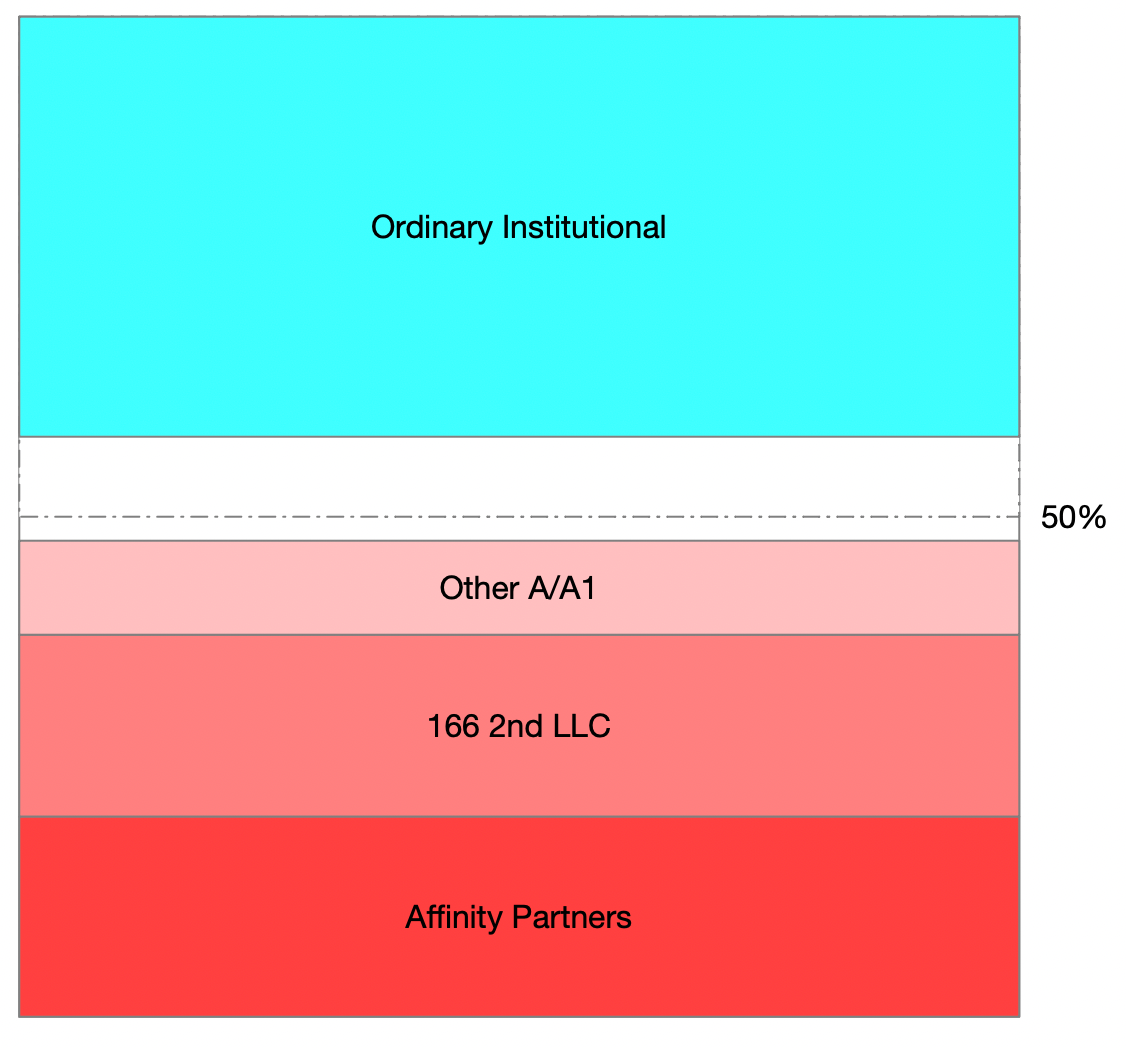

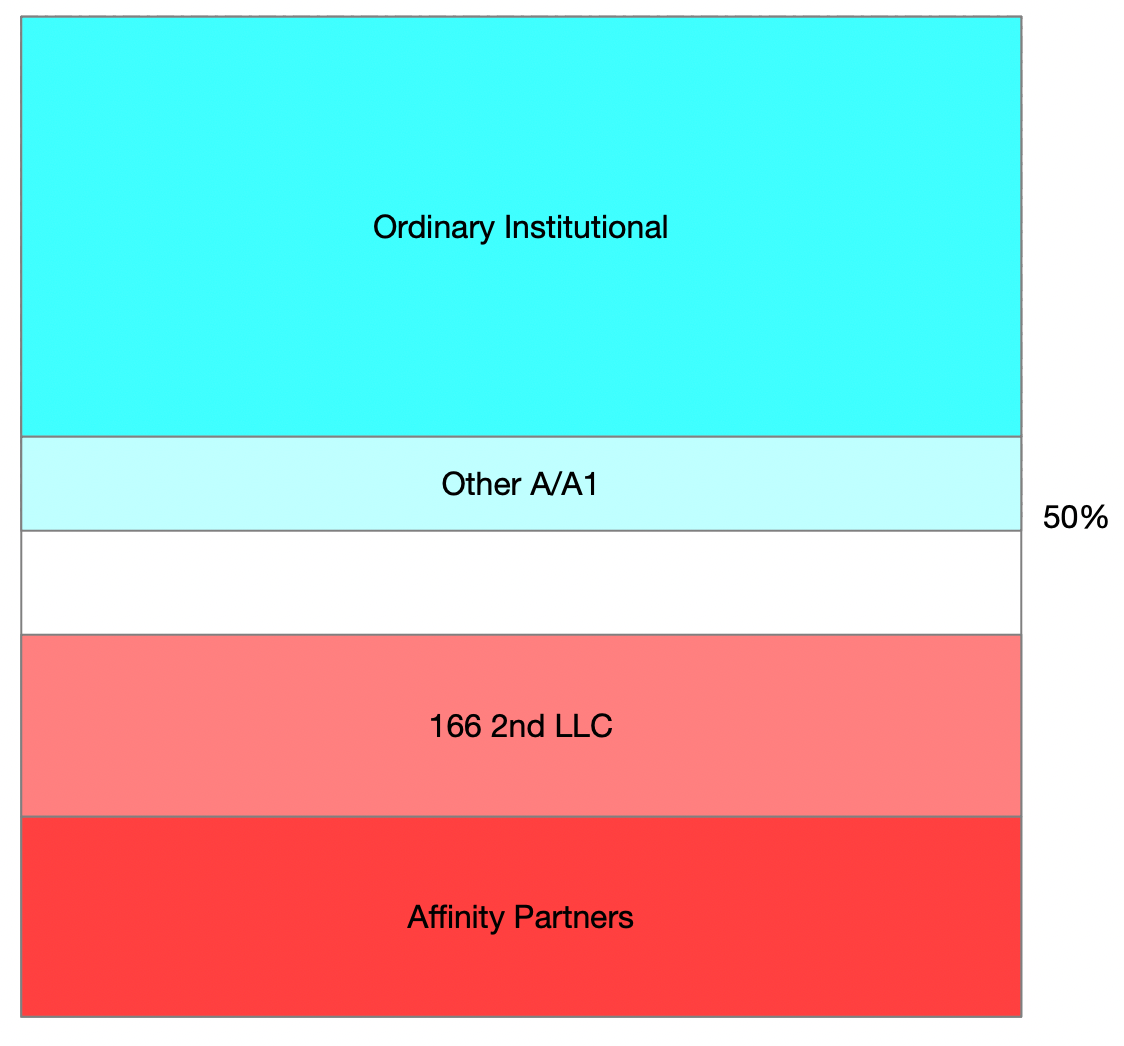

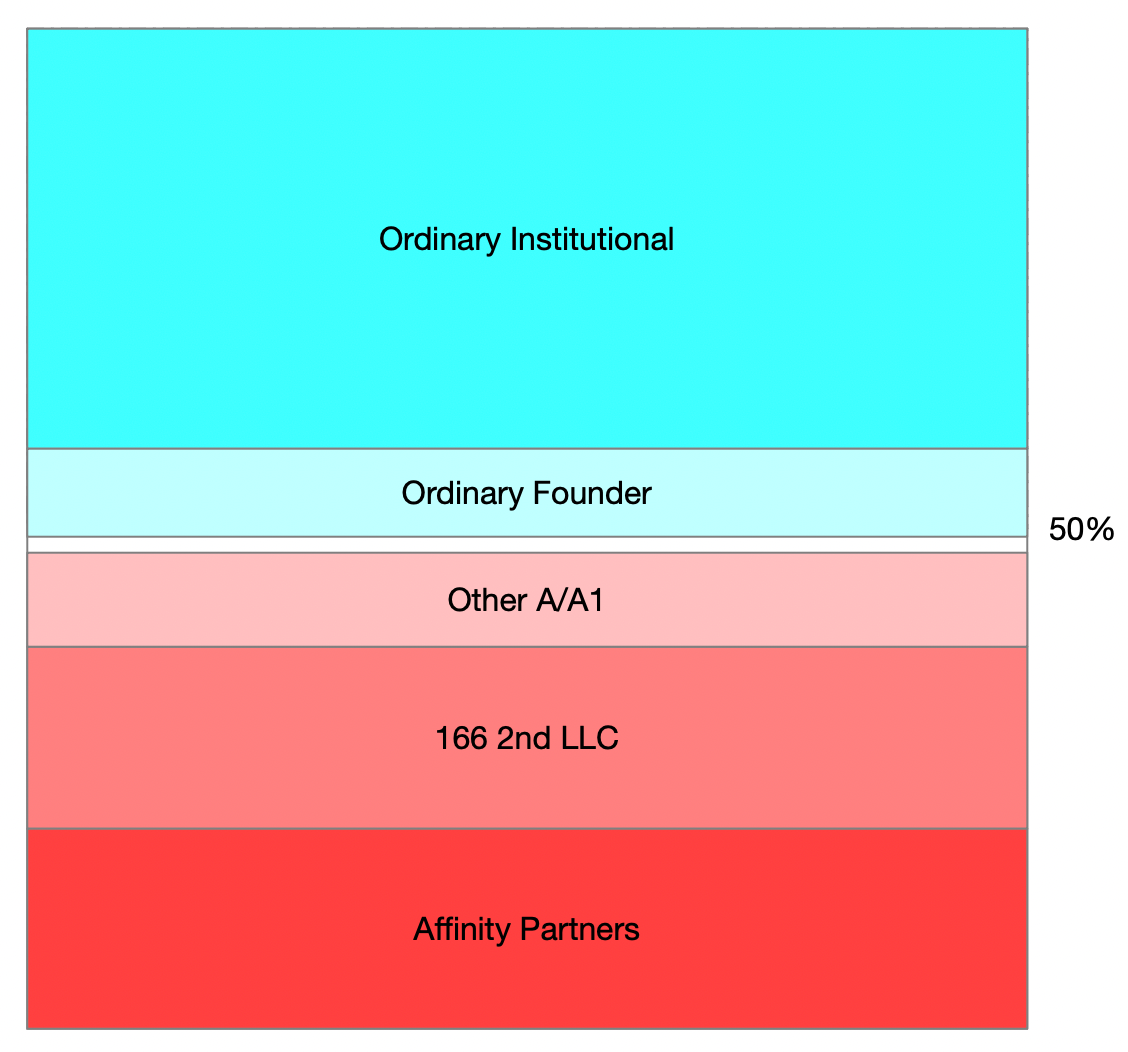

Notice that without the founder's shares (8.9%), any shareholder vote would deadlock between the ordinary (institutional) shareholders and the A/A1 shareholders – neither group had sufficient shares to achieve 50% +1 on any shareholder decision. To illustrate this, let's look at a series of pictures of the distribution of shares in Unybrands Ltd:

Based on all the public documents from the UK Companies Houses and the "prisoner's dilemma-like" situation with respect to the shareholder distributions, I hypothesize the Ordinary (Institutional), Ordinary (Founder), and Other A/A1 shareholders negotiated themselves a "sweet deal" to exit Unybrands Ltd in returns for giving Affinity Partner control of the Unybrands Ltd assets. As the series of images above illustrate, without negotiating some exit for the Ordinary (Institutional), Ordinary (Founder), and Other A/A1 shareholders, it would be impossible to achieve the 50% + 1 shares needed to transfer control.

The just published UBHold Co confirmation statement is spicy because it supports my hypothesis and suggests that Unybrands – like all other Amazon aggregators – may be on life-support; secretly kept alive by Affinity Partners for some unknown reason.

UBHoldCo Capitalization Table

Holy sweet jalapeño peppers! Per the most recent UK Companies House public document, the Ordinary (Institutional) shareholders and almost every single A/A1 shareholder exited when control was passed from Unybrands Ltd to UBHoldCo. The exceptions were:

- Paros Capital AG

- Lawrence Ross Antic Franklyn

- 166 2nd LLC (Adam Neumann)

Of the ~25 A/A1 investors in Unybrands Ltd, ~21 disappeared from UBHoldCo. We will later speculate as to why within the limitations of the information the UK Companies Houses provides sprinkled with some logic and assumptions.

To make it easy to compare how the cap table changed, let me repeat the Unybrand Ltd cap table right below the UBHoldCo table.

To make the comparison easier, I ensured the rows remained in the same exact order. Every name in 'red' is an investor who had shares in Unybrands Ltd but does not have shares in UBHoldCo.

The recent confirmation statement confirms my hypothesis that Affinity Partners took complete control of Unybrands – holding 96% of all shares in UBHoldCo. Since the the UBHoldCo Resolutions published on the UK Companies Houses on 31 July 2024 mentioned a $107M "Affinity Hurdle" before anyone (including Affinity Partners' A shares) receive any distribution, we can infer Affinity Partners invested at least another $32M in excess of their prior A1 $75M investment – for a total of $107M.

If the "Affinity Hurdle" represented an equity investment, it would not be structured in this manner; which suggests the $107M is some sort of debt note owed by Unybrands to Affinity Partners. Since the UK Companies Houses recorded a (debt) charge by CrayHill Aurora Capital and $72M in short-term debt, but we see no charge registered against UBHoldCo, we infer this debt is somehow on Affinity Partners' books in some sort of non-standard structure.

Misdirection Worthy of a Magician

There are three other interesting data points we can extract from the most recent UBHoldCo confirmation statement:

- The co-founder Ulrich Kratz does not appear to have shares in UBHoldCo (none are listed)

- Since the transfer of control to Affinity Partners, no employee who has left bothered to convert any options into shares in UBHoldCo (e.g., Vice President of Growth, Legal Director, Director of Investments & Integration)

- The 2024 press release announcing its series B claimed "The strong investor interest and support reflects confidence in unybrands' attractive performance track-record and growth potential, as well as it's cashflow positive business model and its industry-leading platform" but never mentioned any of the investors, and – in reality and contrary to the PR announcement – the confirmation statement demonstrates almost all the A/A1 investors fled and there was mathematically essentially only a single investor: Affinity Partners ("He Who Cannot be Named" in the PR announcement 😆)

What does it suggest about Unybrands if...

- ...almost all the A/A1 investors fled the cap table?

- ...Affinity Partner's ended up with 96% of the total shares?

- ...no former employee bothered to convert any options into shares in UBHoldCo?

- ...the series B PR announcement about "strong investor interest and support" is at odds with the UBHoldCo cap table, UBHoldCo resolutions, and the possible existence of a >$107M debt-like note?

- ...the Unybrands Co-Founder & CEO has zero (0) shares in UBHoldCo?

Logically, investors would pile into (not out of) a successful business.

Every start-up in the world would use any successful raise to brag about (i.e., name) their investors (not leave them unnamed).

Employees leaving a successful start-up would exercise any vested options to avoid leaving hard-earned sweat equity on the table (paying a non-trivial exercise price to do so).

Every start-up founder has equity in their start-up because it is the primary mechanism for compensation.

The Prisoner's Dilemma

The two confirmation statements demonstrate none of the major players (i.e., Ordinary Institutional, Affinity Partners and 166 2nd LLC) had sufficient shares to force a deal in their favor. They would have to horse trade with the other A/A1 shareholders and the Ordinary (Founder) to enable Affinity Partners to achieve the 50% +1 votes to transfer control from Unybrands Ltd to UBHoldCo.

But the new confirmation statement does not yet explain what horse trading and sweet deal enabled Affinity Partners to end up with 96% of the shares (they only had 19.9% before the transfer of assets from Unybrands Ltd to UBHoldCo). It also does not explain why Jared Kushner would potentially invest >$100M in an Amazon aggregator when practically the entire industry is going bankrupt.

I only ask the questions. Do your own research.

Epilogue

I wrote this post watching that amazing opening scene to "DEADPOOL & WOLVERINE" because it perfectly illustrates the last 2 years of the Amazon aggregation industry. If you put the name of an Amazon aggregator floating above every TVA Minuteman in that scene, you pretty much get a 5-min amusing illustration of the fate of practically every Amazon aggregator thus far.