When you aggregate bags of trash... all you have is a mountain of garbage.

Recently this comment by Jon Derkits on LinkedIn reminded me it is time to revisit my short series from December 2022 about Amazon FBA aggregators.

TLDR summary

In December 2022, I exited the Chief Technology Officer (CTO) role at unybrands soon after my symphonie.ai co-founder left the Chief Supply Chain Officer (CSCO) role (also at unybrands) in November 2022. Ameet Contractor and I helped grow them to 20+ brands, $120M+ in revenue. Soon after my departure, I summarized the lessons I learned in a series of posts:

- The FBA aggregation model was very attractive on paper and had subtle flaws that would doom it to failure

- Buying e-commerce brands is easy; operating them is very hard

- The most valuable asset (i.e., the knowledge and experience of the brand founders) always walked out the door as soon as the transaction was closed

- Financial engineering and accounting tricks make the aggregators look good on paper by masking the tens of millions of dollars they were losing

- Many of the aggregators were founded by Goldman Sachs type of financial raiders who knew how to raise money from gullible investors and had no experience actually running a complex business

- The e-commerce brands acquired by aggregators were often purchased using debt; paying a 3 - 6x EBITDA multiple (or higher), which loaded up the brands with substantial debt payments – which limited the ability of the aggregator to invest cash in "boosting" the brand

- Replacing the small number of brand founders with a large team of aggregator employees made it 1) significantly more expensive to operate the brand; 2) reduced decision velocity, which increased cost (time is money) and reduced performance

So, what happened since then?

Basically the Amazon FBA aggregators held a very exciting bonfire of cash burning through billions of dollars of investor funds in less than 24-months.

- Thrasio went into Chapter 11 bankruptcy with "$500 million and $1 billion in liabilities. It owes more than $5 million to U.S. Customs and Border Protection and roughly $2.9 million to GXO Logistics, among other liabilities. " It lost its entire c-suite of experienced ex-Amazonians, who had been brought in to clean the mess made by the Thrasio founders.

- Benitago went into Chapter 11 bankruptcy less than 24 months after raising $325M in capital. It was acquired out of bankruptcy by relatively unknown Cove Brands whose website essentially has zero information. From the bankruptcy court public filings, it appears that CoVentures, which led their Series A fundraising, was "surprised to learn the business filed [for] bankruptcy" and is behind Cove Brands.

- Elevate Brands was acquired by SellerX, which recently announced its co-founders are walking away after pocketing at least $14M from a tremendous "job well done" – they had layoffs twice in 2022 and again in 2023 so that is sarcasm on my part.

- Perch was acquired by Razor Group, which raised $100M in additional capital and now carries $400M in debt

- D1 Brands “merged” with Suma Brands and re-branded the combined entity as The Ambr Group. ...maybe they could no longer afford an extra vowel?

- Cap Hill Brands "merged" with Juvo, Dragonfly, and Moonshot to form Infinite Commerce. They should have gone with Zord Commerce in tribute to the Power Rangers instead of what seems like a play at the Infinity Gauntlet.

- Win Brands Group has not been winning... it suffered multiple rounds of layoffs between 2022 and 2024

- unybrands was covered in CNBC because it was unable to merge or find a buyer so it took another >$100M from Jared Kushner's Affinity Partners (my estimate from UK Companies Houses public filings and the series B PR) – which if accurate would make the total investment into unybrands by Affinity Partners $175M - 200M or about 10% of the Saudi cash behind Affinity Partners.

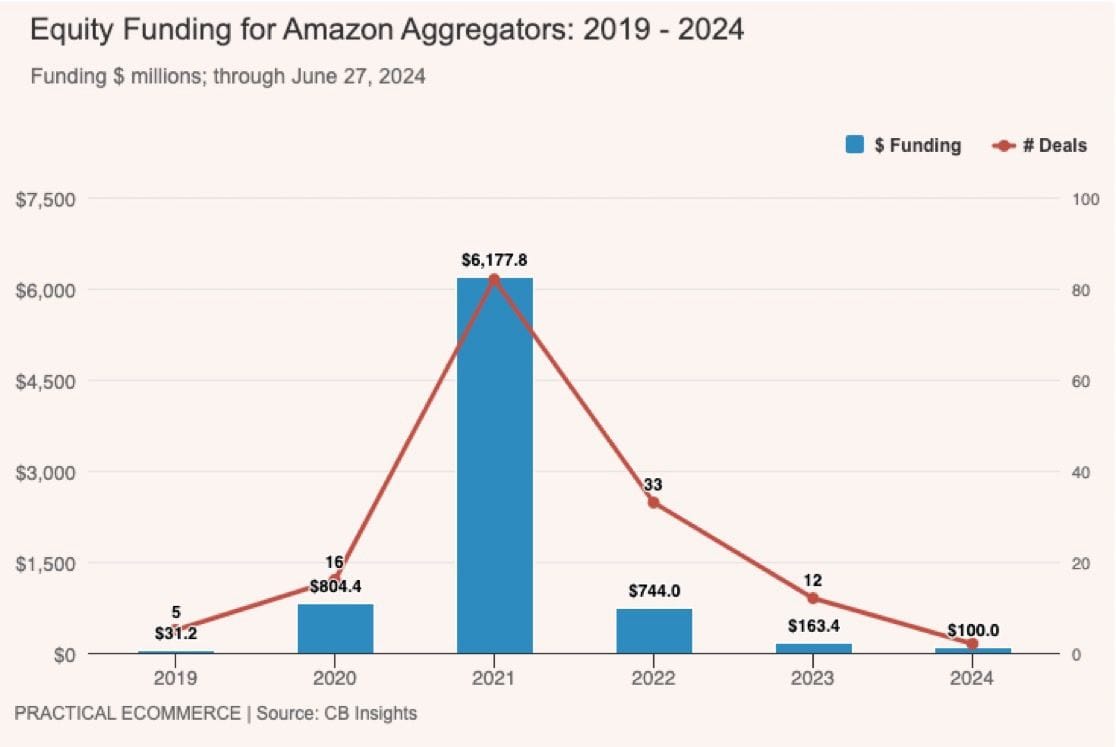

Affinity Partner's initial $75M investment into unybrands in April 2022 was "late to the party" missing the 2021 peak of the aggregator bubble you can see in the graph above by an entire year.

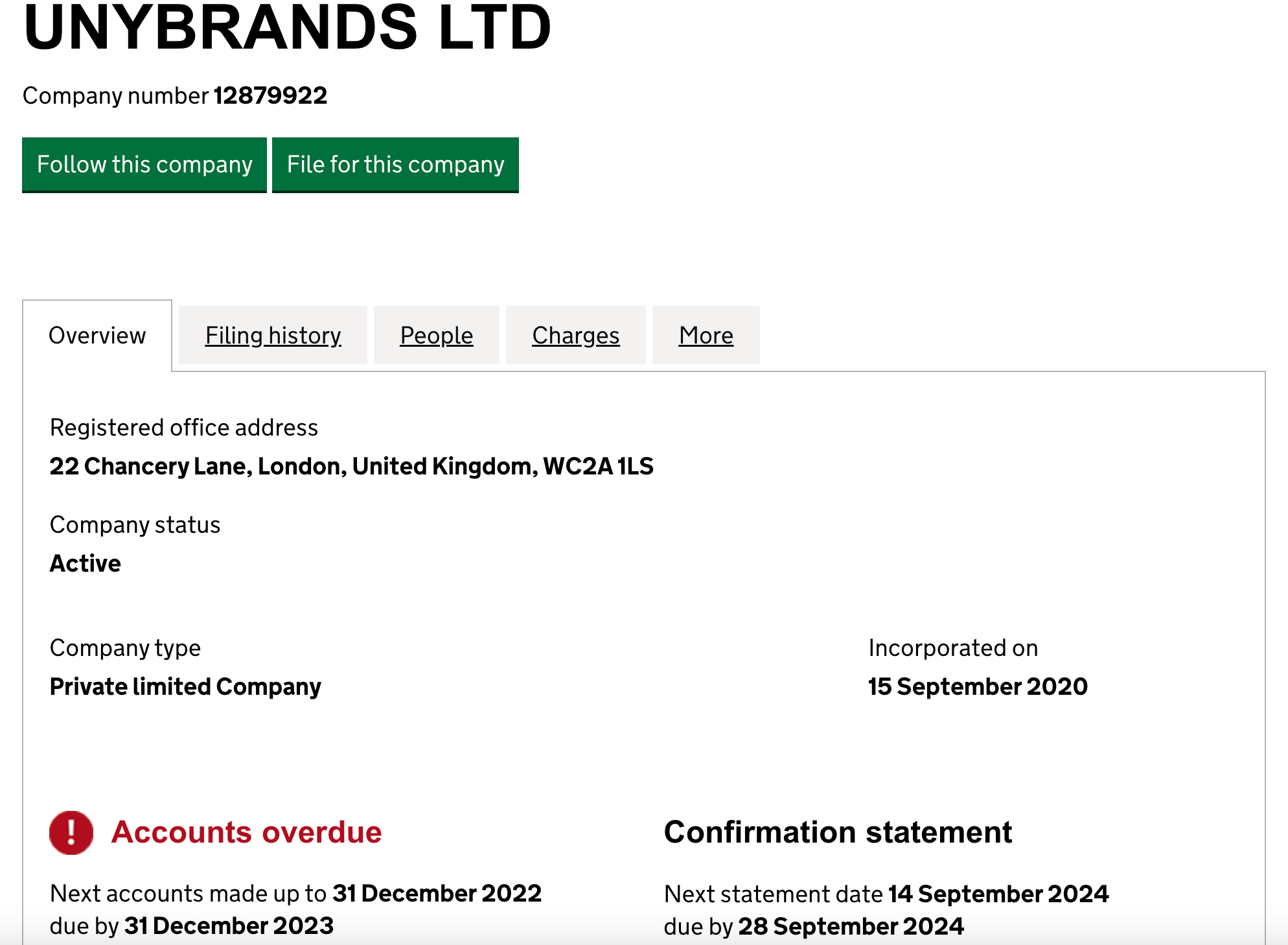

From the UK Companies Houses public filings we see 1) unybrands Operations Ltd lost at least $20M in 2022 alone (page 2), had >$72M in debt (page 13), has not filed audited statements for 2023; 2) the parent unybrands Ltd appears to never have filed audited statements with the UK Companies Houses – making the true losses between the parent and operations entities for 2022 and 2023 unknown but possibly in the significant tens of millions. In fact, as of July 2024 the unybrands Ltd account at the UK Companies Houses is overdue by over 6-months and counting

– and its unybrands operations Ltd assets were transferred (stripped) first to AP Investments II Ltd and later again to UBHoldCo. Perhaps unybrands and Affinity Partners are secretive about the follow-on investment for unusual reasons – their participation was never mentioned in the series B PR. What start-up does not brag about their investors? 🤔

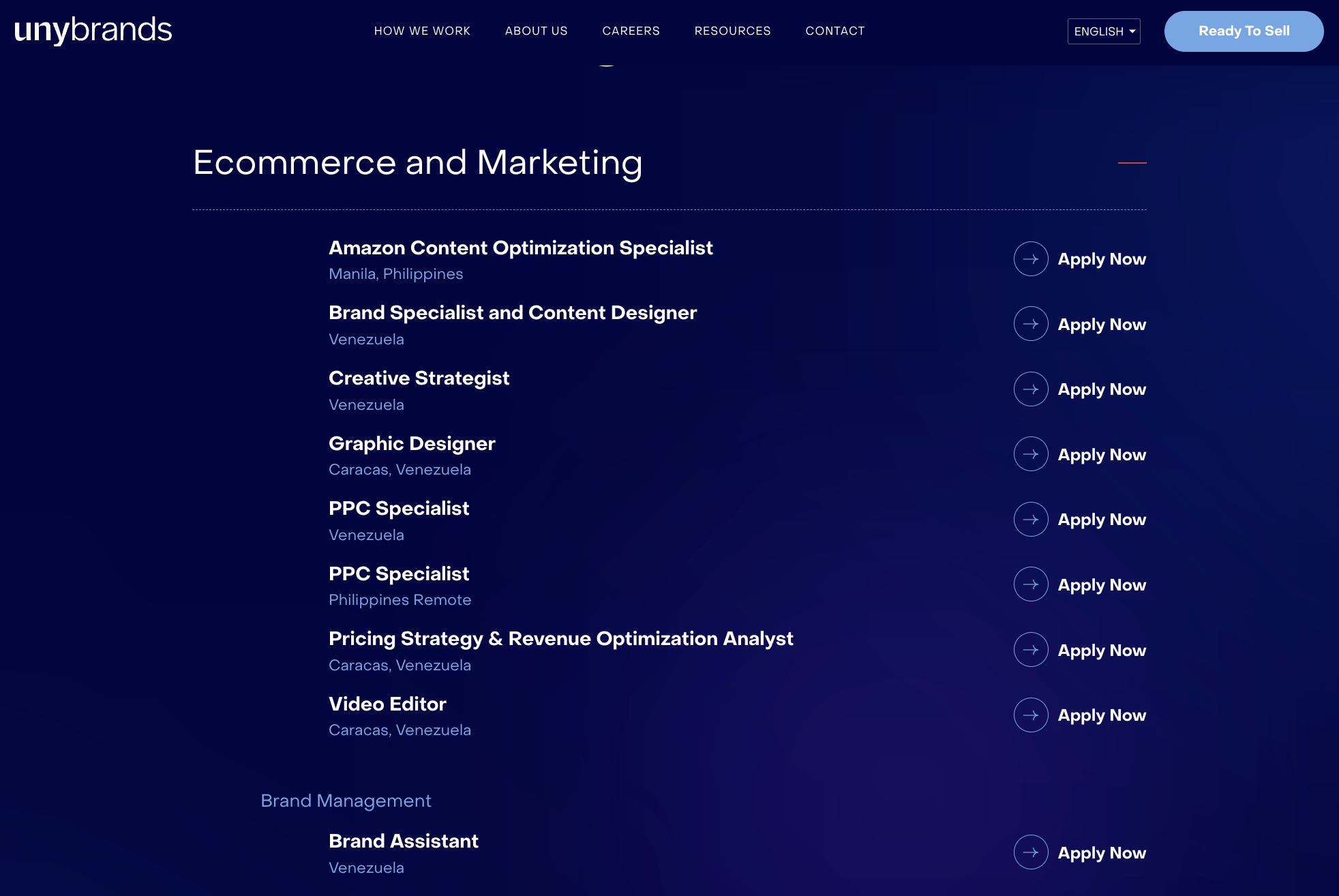

As of July 2024 all open e-commerce roles at unybrands are all in the Philippines and Venezuela – which are not geographies known for e-commerce expertise, which is one of the thesis behind the aggregation business model.

Thrasio is the Godzilla of the aggregation industry and, even with the benefit of Chapter 11 bankruptcy to jettison some heavy debt, S&P had this confidence inspiring summary of its future prospects:

We view Thrasio's capital structure as unsustainable and envision a possible default scenario in the next 12 months due to its tight liquidity and covenant headroom.Despite an about $366 million reduction in the company's amount of funded debt upon its emergence, down from about $3.4 billion of prepetition debt (including preferred equity) prior to the bankruptcy filing, we believe its capital structure remains unsustainable due to its negative EBITDA, negative FOCF generation, and tight liquidity of about $60 million upon emergence.

To be absolutely clear, that opinion from S&P was issued after Thrasio exited Chapter 11 bankruptcy. It is worth reading the entire note from S&P and notice they assigned a CCC+ credit rating to Thrasio (i.e., junk category).

Where do we go from here?

I suspect the fundamental flaws that I wrote about in 2022 remain true in 2024. It seems that - at least for now - some aggregators are avoiding bankruptcy by merging and/or shifting their hiring to rock-bottom low-cost geographies like Venezuela and the Philippines to forestall what I believe is the inevitable disappearance of the FBA aggregators.

In the last 18-months through more reflection on my "in the weeds" experience at unybrands and conversations with others, I realized there are additional flaws with the aggregation business model:

- When an aggregator acquires an e-commerce brand, it has to merge people, processes and technology – this is a challenging process for even a large company and – to some extent – the amount of integration work is independent of the size of the business acquired. Every e-commerce brand acquired by the aggregator brings a different technology stack and business processes that have to be rationalized or the aggregator cannot capture the "economies of scale" behind the theory of aggregation. An aggregator that is constantly absorbing immature small- to medium- e-commerce brands will find itself forced to devote a significant level of resources and capital to the integration process.

- Given the high debt level aggregators take on to acquire e-commerce brands, the capital available to invest into 1) the acquired e-commerce brands; 2) hiring e-commerce expertise; and 3) developing technology is severely constrained. e.g., We saw that every open e-commerce role at unybrands as of July 2024 is in 3rd world countries and the S&P assessment of Thrasio post-Chapter 11 bankruptcy is that it remains debt crippled.

- As retailers and primarily finance driven entities, the aggregators lack the capital, technology expertise and culture to develop the technology e-commerce brands need to grow and scale. Notwithstanding the claim of some aggregators to be "technology companies" – they are retailers who can barely operate the acquired brands let alone develop technology.

The aggregation industry will go the route of the dodo. It is just a matter of time. If you are an investor looking at this industry, caveat emptor. If you are an e-commerce brand thinking of selling to an aggregator, take your pay out in cash effective "due on sale" and avoid accepting any shares in the aggregator as payment for your hard-won effort to grow your e-commerce brand.

Epilogue

I write while listening to music and every post is infused with the "flavor" of a particular song. As an experiment, I will start posting the soundtrack that was running in my head while writing a post. For this, it was Hayden Coffman - "Better Off" because I guarantee between the aggregator industry and "a beer" – you are better off with the beer. It won't disappoint and at least you'll get a return on investment!